Strategic direction for Vietnamese seaweed export to the US

Standing Out with abundant resources and high nutritional value, Vietnamese seaweed is becoming one of the most promising export products today. In this article, AGlobal will provide a comprehensive overview of the seaweed market, growth potential in the U.S., and export strategies for Vietnamese businesses.

1. Overview of Seaweed: Vietnam’s Green Resource

With a long coastline and favorable natural conditions, Vietnam is an ideal place for cultivating, processing, and exporting seaweed. Thanks to its high nutritional value and economic potential, seaweed in recent years has become an important industry, contributing to sustainable marine economic development.

1.1. What is Seaweed? Nutritional Value and Role in Modern Life

Seaweed refers to algae and underwater plants that grow in the ocean, attaching to rocks, coral, or shallow and deep water areas. Through photosynthesis, seaweed becomes an important food source for marine life, while also providing a rich natural source of nutrients for humans.

In modern diets, seaweed is highly valued for its vitamins (A, B, C, E), minerals (calcium, magnesium, potassium, iron, zinc), and essential fatty acids such as Omega‑3 and Omega‑6. These nutrients not only support bone, cardiovascular, immune, and digestive health but also help balance energy and prevent certain chronic diseases.

Beyond its nutritional value, seaweed plays an important role in modern cuisine and lifestyle. Dishes made from seaweed are not only nutritious but also popular for their convenience, cooling effect, and support for body detoxification. Thanks to its diverse health benefits and processing potential, seaweed is gradually becoming a “superfood” favored worldwide.

Read more: Types of Seaweed in Vietnam: Export Potential 2025

1.2. The Most Popular Exported Seaweed Varieties Today

Currently, some types of Vietnamese seaweed have become key export products due to high quality and diverse processing potential. Among them, sea grapes and carrageenan seaweed are the two most commonly exported types.

1.2.1. Sea Grapes

Sea grapes (Caulerpa lentillifera) are one of Vietnam’s main exported seaweed types due to their pleasant taste and high nutritional value. This seaweed is rich in minerals, vitamins, and natural iodine, suitable for fresh dishes, salads, or functional foods.

Sea Grape Dried Export Price History in Vietnam 2022 - 2024 (Source: DirTridge)

According to DirTridge, the export price of dried sea grapes from Vietnam has increased continuously in recent years, from 8.5–10 USD/kg in 2023 to 11.50 USD/kg in 2024, reflecting stable international market demand and growing export potential. Thanks to stable quality and high economic value, sea grapes have become a strategic product contributing to raising the profile of Vietnam’s seafood industry.

Read more: Vietnamese Sea Grapes: Green Superfood with High Export Potential

1.2.2. Carrageenan Seaweed

Carrageenan seaweed (Kappaphycus alvarezii) is an important seaweed species in Vietnam, mainly used to produce carrageenan – a thickening and gelling agent in the food and pharmaceutical industries. With diverse processing potential and high international demand, carrageenan seaweed is considered a strategic export product of Vietnam, targeting markets such as Japan, South Korea, and Europe.

2. Overview of the Current Seaweed Industry in Vietnam 2025

The Vietnamese seaweed industry is currently entering a stage of comprehensive development, not only meeting domestic demand but also expanding into international markets, opening up many new opportunities and challenges for businesses.

2.1. Development of the Domestic Seaweed Market

The domestic seaweed market has been witnessing strong growth, especially on e-commerce platforms. According to Metric, from August 2024 to July 2025, the domestic e-commerce seaweed market reached VND 367.2 billion, reflecting increasing consumer demand.

This development not only creates opportunities for businesses to expand distribution channels but also promotes product diversification and quality improvement, meeting the increasingly sophisticated tastes of Vietnamese consumers.

2.2. Seaweed Exports – A New Growth Driver for Vietnam’s Seafood Industry

According to Fortune Business Insights (2024), the global seaweed market reached USD 17.14 billion in 2023 and is projected to increase to USD 34.56 billion by 2032. With a compound annual growth rate (CAGR) of approximately 8.20%, the global seaweed market is on a strong growth trajectory.

The Asia-Pacific region currently dominates with 77.07% of the global market share in 2023, highlighting significant export potential for countries in the region, including Vietnam.

With abundant raw material resources and cultivation experience, Vietnam is gradually tapping into international markets, making seaweed exports a new growth driver for the seafood industry while enhancing the national brand value on the global food map.

3. Exporting Seaweed to the U.S. – Strategic Path for Vietnamese Businesses

What opportunities can Vietnamese seaweed leverage in the U.S. market, and how can businesses maintain sustainable competitive advantages?

3.1. Strong Growth Potential in the U.S. Market

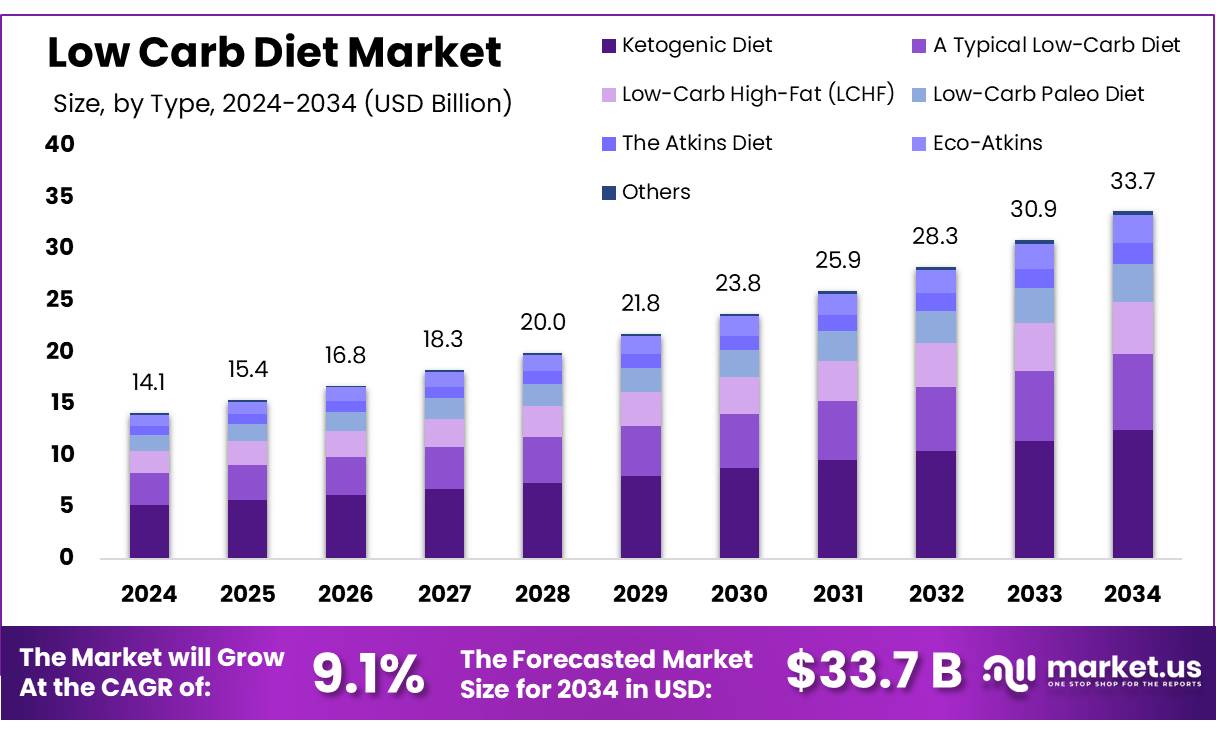

The U.S. market is witnessing significant changes in consumer habits, as people increasingly prioritize healthy, low-carb, and nutrient-rich foods. According to Market.us (2024), the low-carb food market is expected to grow from USD 14.1 billion in 2024 to USD 33.7 billion in 2034, with an average growth rate of 9.1% per year. This reflects the expanding “clean eating” trend.

Global Low-Carb Food Market Forecast 2024 - 2034 (Source: Market.us)

With its richness in vitamins, minerals, and completely natural composition, seaweed is considered an ideal food source for the low-carb, plant-forward trend in the U.S. These positive signals create significant opportunities for Vietnamese businesses to tap into the U.S. market – one of the most promising and stable growth markets for processed seaweed products.

3.2. Competitive Advantages of Vietnamese Seaweed

Vietnam currently possesses considerable potential in seaweed development and export:

- High biodiversity: According to the Nha Trang Institute of Oceanography, Vietnam has up to 887 seaweed species, of which around 137 have economic value, including many used in food, pharmaceuticals, and processing industries.

- Abundant supply, stable production: According to Mr. Tran Dinh Luan – Director General of the Directorate of Fisheries, the country currently has 16,500 ha of seaweed cultivation area, with a production of 150,000 tons in 2023, aiming for 500,000 tons of seaweed and algae by 2030.

- Enhanced processing capacity: Vietnamese businesses are heavily investing in modern processing, preservation, and packaging technologies, extending shelf life while maintaining product quality.

By combining natural resources, stable production, and processing technology, Vietnam holds a solid competitive advantage for expanding seaweed exports.

3.3. Solutions to Promote Exports and Build a National Brand

To fully leverage export opportunities, businesses must strictly comply with international standards such as HACCP, COA, heavy metal, and iodine testing, while being transparent about product origin and production processes. This ensures legality and builds trust with customers and import partners.

To expand markets, businesses can export via major international e-commerce platforms such as Amazon and Walmart, directly reaching millions of global consumers.

At the same time, to accelerate processes and ensure effective export procedures, businesses should cooperate with reputable partners. A notable example is AGlobal, a trusted provider of global export and sales solutions on the Amazon platform, with experience supporting over 200 Vietnamese businesses.

Read more: Top Popular E-Commerce Platforms and Trends in 2025

Read more: A-Z Guide to Selling on Amazon for Beginners

4. Top Seaweed Products Popular in the U.S. Market Today

In the U.S., processed seaweed products such as Nori Snacks (crispy seaweed), Kelp Noodles (carb-free noodles), and Sea Moss (seaweed health supplements) are increasingly attracting consumer attention.

4.1. Nori Snacks: “Clean & Convenient” Trend Captivates U.S. Consumers

Nori Snacks, or crispy seaweed snacks, are increasingly favored in the U.S. due to convenience, appealing taste, and “clean label” ingredients. Versions with low oil, low salt, or premium oils such as avocado particularly attract consumers for light meals, children’s lunch boxes, or keto diets. This trend reflects rising demand for products that are both healthy and easy to carry.

According to Grand View Horizon, the Nori Snacks segment is the largest ready-to-eat seaweed market in the U.S., reaching USD 328.3 million in 2019 and projected to grow at a CAGR of 11.3%, reaching USD 770.3 million by 2027. This shows the market offers great opportunities for new brands to leverage the “clean & convenient” trend and capture high-margin segments.

4.2. Kelp Noodles: Carb-Free Seaweed Noodles for a Healthy Lifestyle

Kelp Noodles, made from seaweed, are highly valued for replacing traditional carbs in low-carb, gluten-free, and vegan diets. Ready-to-Eat (RTE) versions save preparation time and are easy to use. They can be combined into salads, stir-fry, or noodle dishes, providing convenient yet nutritious meals.

According to Fact.MR, the Kelp Noodles segment is projected to grow fastest with a CAGR of 12% from 2025 to 2035, increasing the global market size from USD 96.7 million to USD 300.3 million. This trend highlights clear demand from U.S. consumers for healthy living and weight management.

4.3. Sea Moss: “Marine Gold” in Health Care

Sea Moss, or Irish Moss, stands out for its high mineral content and overall health benefits. Capsules or powdered forms stabilize the product, avoiding unpleasant taste and difficult gel texture. U.S. consumers interested in functional foods turn to Sea Moss to support digestion, boost energy, and supplement micronutrients.

According to Grand View Research, the Sea Moss market reached USD 2.58 billion in 2023 and is projected to grow to USD 2.99 billion by 2030, with a CAGR of 2.1%. Transparent heavy metal and iodine testing by batch, along with substantiated health claims, are crucial factors in building consumer trust.

5. Conclusion

With the growing demand for healthy foods in the U.S. market, the export path is opening up many opportunities for seaweed. Drawing on abundant resources and the knowledge shared in this article, Vietnamese businesses should quickly seize the opportunity to enhance product value and establish their presence in the international market.

AGlobal – the best cross-border e-commerce solution for businesses.

Sign up for a free 1-on-1 consultation tailored to your business sector Here!