Detailed procedures for granting certificates of origin of goods 2025

A certificate of origin is not only a “passport” that helps goods clear customs quickly, but also brings opportunities for tax reduction and affirms international credibility. Let’s explore with AGlobal the detailed procedures for issuing a certificate of origin in 2025 so that Vietnamese enterprises can break through to the world.

1. What is a certificate of origin of goods?

To fully grasp the value of a certificate of origin, businesses need to clearly understand the concept and purpose of issuing a C/O.

1.1. Concept of certificate of origin (C/O)

A certificate of origin (C/O) is a document issued by a competent authority or organization, certifying that goods are produced in a certain country or territory. This is an important legal basis to determine the origin of goods in international trade.

In Vietnam, according to Decree 31/2018/ND-CP, certificates of origin of goods are issued by the Ministry of Industry and Trade or organizations authorized by the Ministry. These include the Vietnam Chamber of Commerce and Industry (VCCI), local Departments of Industry and Trade, and some other specialized units.

1.2. Purpose of issuing C/O in international trade

The purpose of issuing a certificate of origin of goods is not only to support enterprises, but also to serve important management requirements in international trade:

- Determine the legal country of origin: C/O is the basis for customs authorities and stakeholders to accurately determine where goods are produced. This is important because trade policies, tariffs, and quotas are often applied by country.

- Implement trade policies: C/O helps countries apply the correct regulations on tariffs, import quotas, and trade defense measures such as anti-dumping, anti-subsidy, or safeguard measures.

- Ensure compliance with international commitments: In the context of integration, many free trade agreements (FTAs) specify rules of origin. The issuance of C/O ensures goods enjoy preferential treatment correctly while preventing trade fraud.

- Enhance transparency & market control: Through C/O, authorities can control the flow of goods, accurately compile trade statistics, and promptly detect fraudulent origin practices.

Read more: Understanding what competitors are in e-commerce

2. Benefits of having a certificate of origin of goods

Possessing a certificate of origin (C/O) brings many practical benefits to enterprises in international trade activities.

2.1. Enjoy tariff preferences from FTAs

The certificate of origin is a mandatory condition for goods to enjoy preferential tariffs under free trade agreements (FTAs). Thanks to this, enterprises can significantly reduce import costs, optimize selling prices, and enhance competitiveness in international markets.

2.2. Meet legal requirements & import regulations

Many countries require a certificate of origin when carrying out customs procedures. If not presented, shipments may be detained, subject to higher tariffs, or refused entry.

Therefore, C/O plays the role of an “identity card” for import authorities to verify the legal origin of goods, while ensuring compliance with international trade regulations.

2.3. Enhance credibility and transparency of products

When products have a clear certificate of origin, international partners and customers will have more trust in their quality and origin. This is an important factor to build brand reputation and expand long-term markets.

In addition, transparency in origin also helps businesses minimize risks related to trade fraud and protect their legitimate interests in international disputes.

3. Types of certificates of origin of goods

To better understand, let’s distinguish between different types of C/O and learn about common certificate of origin forms today.

3.1. Distinguishing preferential and non-preferential C/O

In international trade, certificates of origin are divided into two main groups.

- Preferential C/O is a type of certificate of origin issued under free trade agreements (FTAs) or tariff preference programs. With this type of C/O, goods are entitled to tariff reductions or exemptions in the importing market, creating a clear competitive advantage for enterprises.

- Non-preferential C/O only certifies the origin of goods without accompanying tariff preferences. This type is usually required to meet general customs regulations or for trade statistics and control purposes.

Clearly distinguishing the two types of C/O helps enterprises proactively choose the appropriate type for each market and export target.

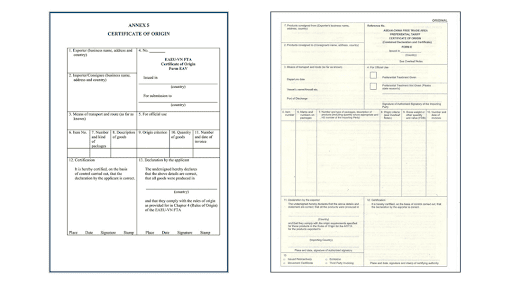

3.2. Common C/O forms (Form A, B, D, E, AK, CPTPP…)

Each trade agreement comes with its own certificate of origin form. The most common include:

- Form A: Applied under the Generalized System of Preferences (GSP).

- Form B: Non-preferential certificate, certifying origin in regular transactions.

- Form D: Used for exports within ASEAN under the ATIGA Agreement.

- Form E: For exports under the ASEAN–China Free Trade Agreement (ACFTA).

- Form AK: Applied for exports to South Korea under the ASEAN–Korea Free Trade Agreement (AKFTA).

- Form EAV: Used under the Vietnam–Eurasian Economic Union Free Trade Agreement (VN–EAEU FTA).

- Form AJ: Applied under the ASEAN–Japan Comprehensive Economic Partnership Agreement (AJCEP).

- Form VJ: Certificate of origin under the Vietnam–Japan bilateral agreement (VJEPA).

- Form AI: Used under the ASEAN–India Free Trade Agreement (AIFTA).

- Form AANZ: Applied when exporting to Australia and New Zealand (AANZFTA).

- Form VC: For exports to Chile under the Vietnam–Chile FTA (VCFTA).

- Form S: Used under the bilateral trade agreement between Vietnam and Laos.

Read more: Top e-commerce platforms and trends in 2025

4. Regulations on procedures for issuing a certificate of origin of goods (C/O)

Procedures for issuing a certificate of origin (C/O) in Vietnam are regulated in Decree 31/2018/ND-CP. This is an important legal basis, ensuring the C/O application process is transparent, consistent, and avoids errors.

When carrying out the procedures, enterprises need to understand three main steps: registering trader dossiers, submitting C/O application dossiers, and receiving results from the competent authority.

4.1. Registering trader dossiers

Before being granted a certificate of origin, enterprises must register their trader dossiers with agencies or organizations authorized by the Ministry of Industry and Trade. This is a mandatory condition when applying for a C/O for the first time.

The trader dossier must provide complete information about the enterprise, business sectors, and exported goods. Only when the dossier is validly approved will the C/O issuing authority consider applications for each subsequent export shipment (Article 13, Decree 31/2018/ND-CP).

4.2. Submitting a C/O application dossier

After having the trader dossier, enterprises submit a C/O application dossier for each shipment. Currently, there are three common submission methods:

- Online declaration on the Ministry of Industry and Trade’s electronic certificate of origin management and issuance system at www.ecosys.gov.vn or other portals authorized by the Ministry.

- Direct submission at the office of the issuing authority/organization.

- Sending dossiers by post.

The dossier must be prepared in the correct form, with all documents required under Article 15 of Decree 31/2018/ND-CP. If information is missing or incorrect, the competent authority will request supplementation or correction before approval.

4.3. Receiving C/O results

After submitting the C/O application dossier, traders will receive results depending on the submission method. The process and processing time are specified in Article 16 of Decree 31/2018/ND-CP as follows:

In case of electronic submission:

- Traders attach relevant documents in electronic form. These must be authenticated with the digital signature of the issuing authority. Paper versions of these documents are not required.

- Within 6 working hours from receipt of a valid dossier, the issuing authority will notify approval results on the electronic system.

- If valid, within the next 2 working hours, the trader will receive the certificate of origin in paper form.

In case of direct submission:

- Traders submit complete documents as required at the issuing authority’s office.

- The authority is responsible for providing results within 8 working hours from receipt of a complete and valid dossier.

In case of postal submission:

- The maximum processing time is 24 working hours from the date the issuing authority receives a valid dossier, according to the postmark date.

- Thus, enterprises should choose the appropriate method to ensure export schedules and avoid delays in customs clearance.

Read more: Export services & what businesses need to know

5. Conclusion

In the context of 2025, when transparency and international standards are increasingly stringent, the certificate of origin has become a mandatory factor for Vietnamese goods to go global. This is not only a legal procedure but also proof of credibility and product quality in the global market.

To maximize the value of C/O, enterprises need to proactively update new regulations, prepare complete dossiers, and follow proper procedures. This thorough preparation will help goods not only overcome trade barriers, but also open opportunities for fair competition, enhance export advantages, and affirm Vietnamese brands on the world economic map.

AGlobal – The best cross-border eCommerce solution for businesses.

Register now for a free 1-on-1 consultation tailored to your industry and sector Here!