What is international payment? The role of popular games and formulas.

In the context of increasingly deep economic integration, international payments play a key role in connecting the flow of capital, goods, and services between countries. According to CorporateVisa , the value of cross-border payments could exceed USD 250 trillion annually, highlighting the essential importance of this activity to the global economy

1.Overview of International Payments

In the context of strong globalization, international payments play a vital role as a key link connecting economic entities across different countries. Through international payment activities, the flow of funds between nations is ensured to move smoothly, securely, and efficiently

1.1. What Are International Payments?

International payments refer to the process of transferring money between parties in different countries to fulfill arising financial obligations. Typical international payment activities include cross-border trade in goods, payment of overseas tuition fees, foreign investment, and other lawful transactions. These payments are usually conducted through banks or intermediary payment service providers.

Due to the involvement of foreign currencies, legal frameworks, and multiple parties across different jurisdictions, international payments are significantly more complex than domestic payments. To ensure transparency, security, and legality, international payment activities are subject to strict regulations and international financial practices.

1.2. The Role of International Payments in Trade

International payments serve as a bridge that facilitates cross-border capital flows, enabling the growth of global trade. For businesses, international payments ensure timely receipts and disbursements, help maintain credibility with partners, and reduce financial risks. At the macro level, this activity contributes to promoting imports and exports, attracting investment, and advancing international economic integration

2. International Payment Methods

Each international payment method is designed to suit different transaction contexts. Therefore, choosing the appropriate payment method plays a crucial role in ensuring transaction efficiency and financial security for businesses.

2.1. Telegraphic Transfer (T/T)

Telegraphic Transfer (T/T) is a method in which the payer requests a bank to transfer a specified amount of money to a beneficiary abroad. This method is simple, fast, and low-cost, and is commonly used when the parties have a high level of mutual trust. However, risks may arise if either party fails to fulfill its commitments

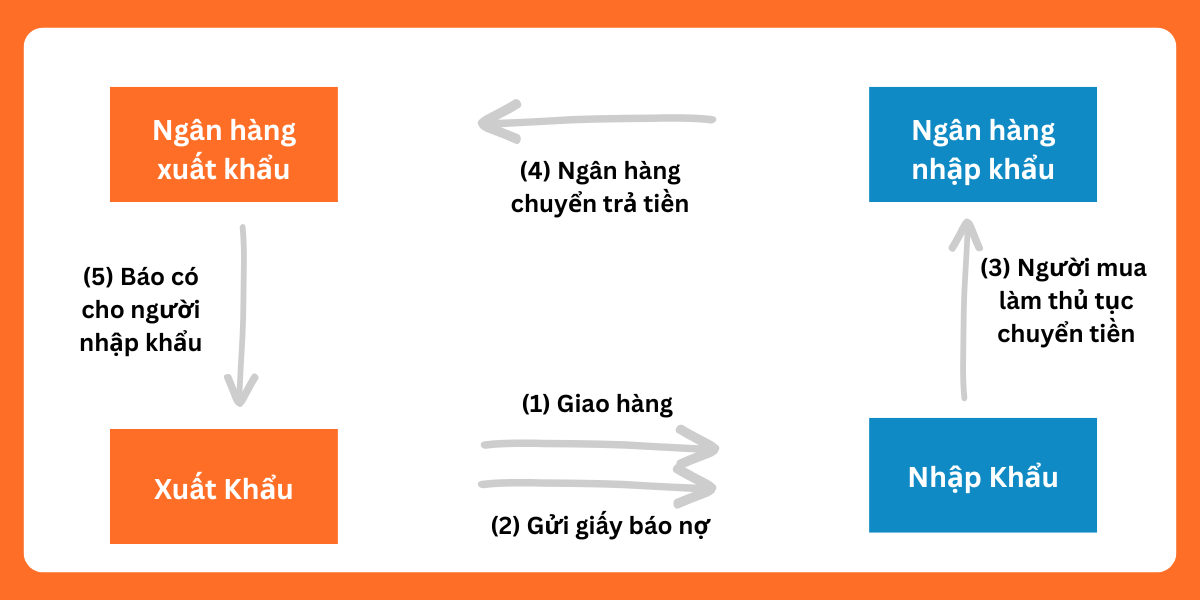

2.2. Collection Method

Collection is a payment method in which the exporter entrusts a bank to collect payment from the importer based on a set of shipping documents. This method offers a higher level of security than T/T and is suitable for medium-value transactions with relatively reliable partners

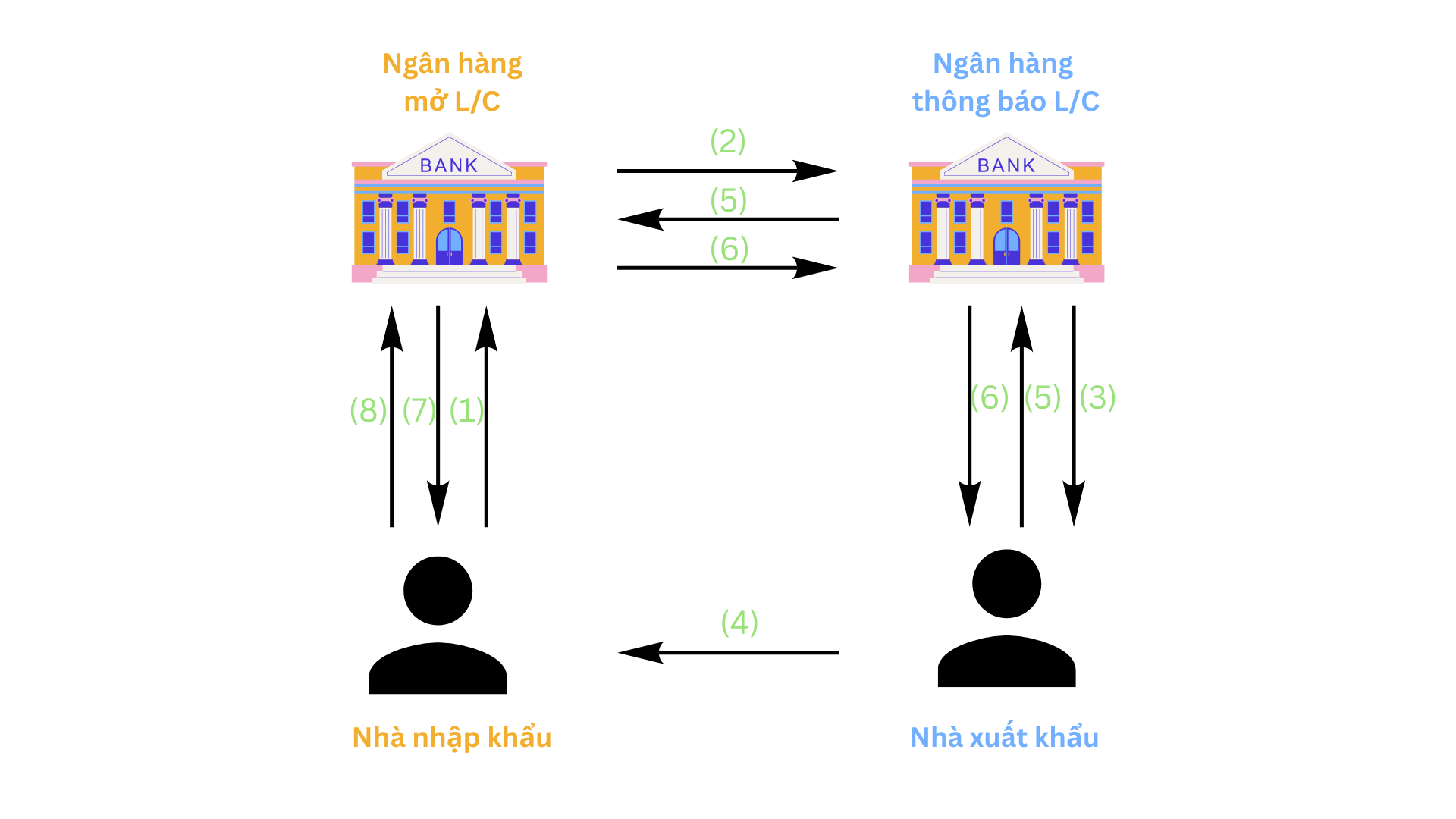

2.3. Letter of Credit (L/C)

A Letter of Credit (L/C) is a payment method in which a bank undertakes to pay the exporter provided that the presented documents fully comply with the stipulated terms and conditions. This is considered the safest method in international payments and is typically applied to high-value contracts, although it involves higher costs and more complex procedures

2.4. Comparison of the Advantages and Disadvantages of International Payment Methods

Each international payment method has its own advantages and disadvantages. T/T offers low costs but carries higher risks; L/C provides strong security but is more expensive and complex; while collection serves as an intermediate solution. Businesses should consider transaction value, partner reliability, and risk tolerance when selecting the most suitable payment method

3. Reputable International Payment Service Providers Today

Currently, many cross-border payment platforms have emerged to support individuals and businesses in sending and receiving international payments quickly and conveniently. Below are some of the most popular international payment platforms today

3.1. LianLian Global

Trusted by more than 7.9 million customers and partners worldwide, LianLian Global provides cross-border payment solutions such as international e-wallets and payment gateways, enabling businesses to conduct transactions quickly and securely.

Services provided by LianLian Global:

-

Cross-border e-wallet: receiving accounts, virtual cards, global payments, and withdrawals to local banks.

-

Payment gateway: international credit/debit card payments, local payment methods, and payment integrations.

-

Customized payment solutions tailored to the specific needs of each business.

3.2. PingPong

Được thành lập tại New York vào năm 2015, PingPong cung cấp giải pháp thanh toán xuyên biên giới dành riêng cho thương mại điện tử. Cho đến nay, nền tảng đã phục vụ gần 1 triệu e-seller trên toàn thế giới. PingPong mang đến những dịch vụ giá trị, chi phí cạnh tranh tới các e-seller trong nhiều mảng hoạt động khác nhau như: Amazon, Shopify, Woo-ecommerce, Affiliate Marketing, Esty, Print On Demand.

Những dịch vụ của PingPong hiện nay:

-

Thanh toán quốc tế với đa dạng tiền tệ

-

Thanh toán cho nhà cung cấp

-

Cung cấp Thẻ ảo trả trước phát hành bởi các ngân hàng uy tín

-

Chuyển đổi ngoại tệ đơn giản và thuận tiện

-

Chuyển khoản nội bộ

-

Quản lí nhiều người dùng từ 1 tài khoản duy nhất

3.3. Payoneer

Payoneer được xây dựng với mục tiêu giúp doanh nghiệp ở mọi quy mô dễ dàng tiếp cận thương mại toàn cầu. Nền tảng này hỗ trợ quản lý kinh doanh với nhiều đơn vị tiền tệ, mở rộng sang các thị trường quốc tế mới. Ngoài ra, Payoneer còn cung cấp giải pháp vốn lưu động, giúp doanh nghiệp thúc đẩy tăng trưởng toàn cầu.

Dịch vụ mà Payoneer cung cấp:

-

Freelancer: nhận thanh toán, thực hiện thanh toán, quản lý doanh nghiệp.

-

Doanh nghiệp: quản lý lực lượng lao động toàn cầu, nhận thanh toán, quản lý doanh nghiệp, thực hiện thanh toán.

-

Buôn bán trực tuyến: thanh toán, quản lý tiền tệ, thu thanh toán.

3.4. WorldFirst

WorldFirst was established with the mission of helping businesses operate more smoothly in the global market. The platform offers international payment solutions and comprehensive financial services to support businesses in expanding and growing their cross-border operations.

Key highlights of WorldFirst:

-

World Account allows businesses to open local currency accounts in more than 15 currencies.

-

Supports payments in over 90 currencies and collections in more than 20 currencies.

-

Enables transactions with international suppliers at competitive foreign exchange rates.

-

Allows receiving payments from over 130 major e-commerce marketplaces and payment gateways

4. Current Trends in International Payments

Current Trends in International Payments

Today, international payments are undergoing significant changes in terms of technology, costs, and compliance requirements. The following trends are shaping how businesses conduct cross-border transactions.

4.1. Increased Transparency and Stricter Compliance in International Payments

Greater transparency in payment information in line with FATF standards is forcing banks and intermediary institutions to strengthen data control processes, anti–money laundering (AML), and counter–terrorist financing (CTF) measures. This enhances the overall safety of the international payment system and reduces risks. However, it also increases compliance costs and imposes higher documentation and procedural requirements on businesses involved in cross-border transactions.

4.2. Promotion of Real-Time International Payments and Cost Optimization

Growing cooperation among countries to develop real-time payment systems is creating major improvements in transaction processing speed. Transfer times are being shortened, intermediary costs reduced, and cash flow efficiency enhanced, benefiting import–export businesses and improving overall operational performance.

4.3. Increasing Regulatory Pressure on Payment Intermediaries

New reporting and regulatory requirements for Payment Service Providers (PSPs) are forcing payment companies to invest heavily in technology infrastructure and risk management systems. As a result, the international payments market is becoming more selective, favoring providers with strong compliance capabilities and well-structured operating systems.

4.4. Infrastructure Fragmentation and Competition

Fragmentation in international payment infrastructure arises from the fact that each country adopts different payment systems, technical standards, and levels of digitalization. While some markets have implemented real-time payments, many countries still rely on traditional systems with slower processing times.

In addition, differences in correspondent banking networks and intermediary roles increase transaction costs and risks. Variations in foreign exchange policies and capital control regulations further complicate standardization across payment processes.

Read more: International Payment Regulations

5. Conclusion

It can be seen that international payments play a pivotal role in global trade and transactions. Understanding payment methods, choosing reputable service providers, and keeping up with emerging trends enable businesses to optimize costs, minimize risks, and enhance competitiveness in the international marketplace.

AGlobal – the leading cross-border e-commerce solution for businesses.

Register for a free one-on-one consultation tailored to your business industry here!