Seaweed Varieties in Vietnam: Export Potential 2025

When the green consumption trend spreads globally, seaweed in Vietnam is emerging as a “green gold source” rich in potential and economic value. With the advantage of favourable natural conditions, competitive costs and flexible market adaptability, Vietnamese seaweed is expected to become a strategic export product in 2025.

1. Overview of the Vietnamese seaweed market

The seaweed market is opening up many new opportunities for Vietnamese businesses. Before analysing export trends, let’s explore the core values and current development situation of various types of seaweed in Vietnam.

1.1. Seaweed – The “green gold” rich in nutritional and economic value

Seaweed has long been considered the “green gold” of the ocean – not only highly nutritious but also offering sustainable environmental benefits. According to the Director General of the Directorate of Fisheries, this is a low-investment but high-efficiency industry, contributing to livelihoods for coastal residents and protecting the ecological environment.

Not only rich in minerals, trace elements and fibre, seaweed also contains fucoidan, agar, and carrageenan. These are compounds of high value in pharmaceuticals, cosmetics, biofertilisers, and green fuels.

In addition, seaweed has the ability to absorb CO₂, nitrogen, and phosphorus, helping reduce pollution and limit ocean acidification. Seaweed by-products are also utilised for animal and aquaculture feed, contributing to the reduction of methane emissions.

With its environmentally friendly characteristics and diverse applications, Vietnamese seaweed is becoming a potential pillar in the green agriculture and circular economy development strategy promoted by the Government.

1.2. Current situation of seaweed exploitation and cultivation in Vietnam

In Vietnam, the seaweed industry has developed strongly in the North Central and South Central regions, where natural conditions are favourable. Our country has 827 natural seaweed species, of which 88 have economic value, divided into three main groups: cottonii seaweed, gracilaria seaweed, and sea grapes.

By 2023, the seaweed cultivation area reached approximately 16,500 hectares out of 900,000 potential hectares, with an average yield of 150,000 tonnes per year. However, this scale remains modest due to inconsistent seed quality, limited processing technology, and a lack of clear export standards.

According to the Marine Aquaculture Development Plan to 2030, Vietnam aims to reach 500,000 tonnes of seaweed per year. Key areas such as Thanh Hoa – Quang Binh will focus on developing sea grapes, cottonii seaweed, and gracilaria, combining multi-species farming to optimise productivity and protect the environment.

2. Common types of seaweed in Vietnam

According to the Nha Trang Institute of Oceanography, our country has recorded 827 natural seaweed species. Below are five popular types of seaweed that are contributing to the sustainable and green development of Vietnam’s seaweed industry.

2.1. Sea grapes

Sea grapes (Caulerpa lentillifera) are dubbed “the green caviar of the ocean” thanks to their crisp, fresh taste and rich nutritional value. This species contains abundant vitamins A, C, calcium, iron, and antioxidants – beneficial for health and skin.

Sea grapes are mainly cultivated in Khanh Hoa, Ninh Thuan, and Phu Yen, where the water source is clean and salinity is stable. This product is currently in high domestic demand and is also exported to some Asian markets thanks to its “clean, fresh, mineral-rich” advantages.

2.2. Sargassum seaweed

Sargassum (Sargassum spp.) is a brown seaweed that naturally grows along the central coast. It is rich in iodine, alginate, and fucoidan and is often used to extract natural gel-forming substances, and to produce cosmetics, functional foods, and biofertilisers.

In addition to its economic value, Sargassum can absorb carbon and improve seawater quality, helping to reduce pollution and support the development of the blue economy.

2.3. Gracilaria seaweed

Gracilaria (Gracilaria tenuistipitata) is a red seaweed with high economic value, widely cultivated in Thua Thien Hue, Quang Ninh, and Nam Dinh. It is the main raw material for producing agar, a natural gelling agent important in the food and pharmaceutical industries.

Thanks to its easy cultivation, simple harvesting, and stable profitability, Gracilaria farming is being expanded in many localities, contributing to the diversification of Vietnam’s seaweed varieties.

2.4. Sea lettuce

Sea lettuce (Ulva lactuca), also known as green lettuce, is a common green seaweed in the central coastal region. This species contains high levels of protein, fibre, B vitamins, and minerals, and is used in cuisine and functional food production.

Furthermore, sea lettuce is being researched for use in biofertilisers and water treatment materials, providing great biological value within the current green agriculture trend.

2.5. Cottonii seaweed

Cottonii seaweed (Kappaphycus alvarezii) is one of the most economically valuable types of seaweed in Vietnam. This red seaweed is widely cultivated in the South Central and Southern regions, where the seawater is clean and the temperature remains stable year-round.

Cottonii is the main raw material for carrageenan – a natural thickening agent widely used in food, pharmaceutical, and cosmetic industries. With global demand rising, cottonii is considered a strategic direction for the future of Vietnam’s seaweed industry.

3. Export potential of Vietnamese seaweed in the international market

The global seaweed market is entering a strong growth phase, creating many opportunities for exporting countries, including Vietnam.

3.1. Rising global demand for seaweed

In recent years, the global seaweed market has grown rapidly thanks to the green consumption trend and increasing demand for plant-based products. Seaweed has gradually become a sustainable raw material that meets the needs of the food, pharmaceutical, and cosmetic industries.

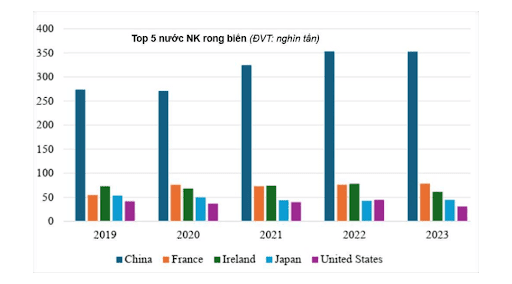

In 2023, global seaweed exports reached approximately 819,100 tonnes, valued at an estimated 3.21 billion USD. These products have been distributed to nearly 100 countries, with East Asia, Europe, and North America being the main import markets.

Source: VASEP

Currently, over 80% of seaweed production is used for direct consumption, while the rest serves the food, pharmaceutical, cosmetic, and agricultural industries. Compounds such as carrageenan, agar, and alginate are widely applied in food processing, cosmetics, and pharmaceuticals.

As consumers increasingly prioritise sustainable and nutritious products, seaweed demand is forecast to continue rising in the coming decade. This is a golden opportunity for Vietnamese businesses looking to expand seaweed exports to international markets.

3.2. Competitive advantages of Vietnamese seaweed in the international market

The types of seaweed in Vietnam possess many strengths that help enhance their competitive position in the international market:

- Favourable natural conditions:

Vietnam has a long coastline, clean waters and a mild tropical climate, very suitable for seaweed cultivation all year round. Key economic species such as Kappaphycus and sea grapes grow strongly in the South Central region – where salinity is stable and the water source is clear.

- Good raw material quality:

According to the Nha Trang Institute of Oceanography (2023), Vietnamese Kappaphycus contains carrageenan content ranging from 41% - 45%, meeting standards for the food and pharmaceutical industries. This is a high index that helps Vietnamese seaweed to be highly evaluated for viscosity and gel-forming ability.

- Product diversity and processing capability:

In addition to raw materials, domestic enterprises have produced fresh sea grapes, salted sea grapes, seaweed powder, agar, carrageenan and health care products. This helps Vietnamese enterprises to increase export value instead of merely supplying raw materials.

- Competitive production costs:

Thanks to abundant labour resources, low labour and infrastructure costs, Vietnam is able to supply products at reasonable prices while ensuring quality, enhancing competitiveness in markets such as Japan, Korea and Europe.

3.3. Barriers to bringing Vietnamese seaweed to the international market

Although there is much potential, Vietnam’s seaweed industry still faces a number of challenges:

- Limited deep processing technology:

Most products are still exported in raw or semi-processed form, resulting in low added value. International-standard agar and carrageenan extraction lines remain limited, making it difficult to expand market share in the premium segment.

- Strict quality standards:

Major import markets such as Japan, the EU and the US require strict control over heavy metals, microorganisms, antibiotic residues, and demand that enterprises obtain HACCP, ISO or GMP certifications. Compliance with these standards requires significant investment in equipment and management.

- Unstable supply sources:

Heavy dependence on weather, seed quality and small-scale farming areas causes inconsistent yield and quality. The lack of large-scale seaweed farming areas leads to the risk of raw material shortages for long-term export orders.

- Weak supply chain and logistics:

The linkage between farming – processing – transportation is still loose, while logistics costs are high and traceability processes are not standardised. This reduces the competitiveness of Vietnamese seaweed products in the international market.

Read more: What is the international market? Potential and challenges

4. Exporting Vietnamese seaweed through Amazon: An effective direction for businesses

Instead of relying on traditional distribution channels, many businesses are turning to Amazon as a “global gateway” to bring Vietnamese seaweed products to the world.

4.1. Why Amazon is a suitable channel for Vietnamese seaweed products

Amazon is the largest online retail platform in the world. With over 300 million active shoppers globally, particularly in the US, Canada and Europe, Amazon helps Vietnamese businesses easily reach communities of consumers who favour vegetarian, healthy and sustainable foods.

The “Superfood” and “Vegan” trends are rapidly growing on Amazon, opening up huge opportunities for Vietnamese seaweed products.Businesses can take advantage of trending keywords such as “Vegan Superfood”, “Seaweed Snack”, or “Organic Seaweed” to position products and reach target customer groups.

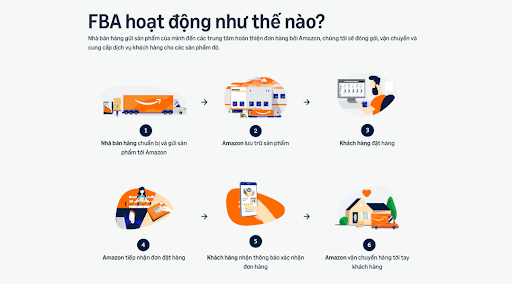

In addition, the Fulfilment by Amazon (FBA) service helps Vietnamese businesses optimise export operations. Amazon handles packaging, delivery, and customer service, saving time and costs. This model is particularly suitable for Vietnamese seaweed – a dry, lightweight, easy-to-preserve product that is convenient for global market expansion.

Read more: Amazon FBA – An effective cross-border sales support service

4.2. Potential Vietnamese seaweed products on Amazon

Among the types of seaweed in Vietnam, the processed and dried seaweed group is considered the most suitable for export through Amazon. This group of products can be preserved for a long time, has low transportation costs and easily meets FBA system requirements.

The greatest advantage of processed seaweed products is their long shelf life, averaging 12–24 months. This allows businesses to be proactive in production planning, storage and international distribution while ensuring stable product quality.

Potential Vietnamese seaweed product lines include:

- Salted and dried sea grapes: Retain natural flavour, easy to store, and suitable for modern consumers who favour healthy food.

- Seasoned and ready-to-eat seaweed: One of the best-selling categories in Amazon’s Snack & Gourmet Food section, thanks to its crisp texture, mild flavour and high convenience.

- Dried Kappaphycus and Gracilaria: Used as raw materials for agar and carrageenan extraction, serving the food, pharmaceutical and cosmetic industries.

4.3. Secrets to helping Vietnamese seaweed products succeed on Amazon

To make Vietnamese seaweed competitive, businesses need to focus on the five factors below:

Ensure quality and certification

Products must meet international standards such as FDA, HACCP or ISO for food safety. For the premium segment, businesses should add USDA Organic certification to elevate brand reputation and expand the international customer base.

Build a unique brand

Do not sell under generic brands. Tell the brand story of “Green Food from Vietnam”, emphasising the natural, clean and sustainable origin of Vietnamese seaweed. Clear images and lively instructional videos help build trust and emotional connection with customers.

Optimise visibility with SEO and PPC advertising

Use trending keywords such as “Seaweed Snack”, “Vegan Superfood” or “Organic Dried Seaweed from Vietnam”. Combine with Amazon PPC campaigns to boost visibility, attract positive reviews and increase conversion rates.

Focus on packaging

To make a strong impression on customers, businesses should invest in modern, eco-friendly packaging that highlights Vietnamese origin through characteristic colours and imagery. The packaging should clearly present information such as ingredients, health benefits, and quality certifications to increase credibility.

Flexible pricing and promotions

Prices on Amazon fluctuate constantly, so businesses must monitor competitors in the same segment to adjust pricing appropriately, avoiding excessive price cutting. At the same time, they can combine coupons, flash sales, or promotional combos to attract new customers and retain existing ones.

Read more: Amazon Store – A platform that helps brands shine

5. Conclusion

The year 2025 opens up great opportunities for Vietnam’s seaweed industry as global demand for green food rises sharply. With abundant raw materials, reasonable costs, and improving quality, Vietnamese seaweed products are gradually affirming their position on the global export map.

To fully exploit export potential, Vietnamese businesses need to invest in deep processing, standardise quality, and make effective use of cross-border e-commerce platforms such as Amazon.

This is an opportunity for the Vietnamese seaweed industry to expand its reach and make its mark on the global agricultural map.

AGlobal – the best cross-border e-commerce solution for businesses. Register for free one-on-one consultation tailored to your industry Here!