US Pepper Market 2025: Solutions for Vietnamese Exports

The US pepper market in 2025 opens up many great potentials, but at the same time also poses many challenges in terms of quality and competitive standards. To conquer this demanding market, businesses need to understand consumer trends, comply with international standards, and proactively implement sustainable competitive solutions.

1. Overview of the pepper industry in the US

Revealing the overall picture of the US pepper market in 2025, what are the most outstanding trends?

1.1. The overall picture of the US pepper market 2025

In 2025, the US continues to play the role of the largest pepper importing market in the world. In the first 5 months of 2025, the US imported more than 36 thousand tons of pepper, worth 273 million USD, down 3.3% in volume compared to the same period but still maintaining a high import level.

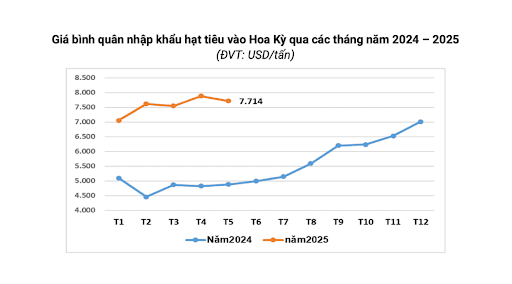

Pepper prices in the US during this period tend to increase. The reason comes from fluctuating supply in major producing countries, high transportation costs, and a 20% counter-tax policy that the US imposed on Vietnamese goods from Q2/2025. However, this tax rate is still much lower than Brazil and India (50%), helping Vietnamese pepper maintain its competitive advantage.

Besides the price factor, consumption habits also change significantly. Americans are paying more attention to certified organic products, transparent origin, and environmentally friendly. Demand for processed products such as ground pepper, white pepper or premium pepper lines is also increasing.

Source: ITC

Source: ITC

1.2. Vietnam – the largest pepper supplier to the US market

The US continues to be the largest export market for Vietnamese pepper, accounting for about 26% of total turnover in the first 7 months of 2025. Although export volume decreased by 24% to nearly 33 thousand tons, export value increased by 21%, reaching 248 million USD thanks to higher export pepper prices.

Vietnam still maintains its position as the main supplier, accounting for up to 64.4% of the total pepper imports of the US. Compared to competitors, Vietnam has a clear advantage when the tax rate is only 20%, while Brazil and India are up to 50%. Indonesia imposes 19% tax but is not enough to create significant competitiveness.

According to VPSA, exports to the US in Q3/2025 will face difficulties due to tariff impacts. However, from Q4/2025 and Q1/2026, the outlook is forecast to be more positive as importers increase reserves for the peak season.

In general, the US continues to affirm its position as a key pepper export market, both potential and challenging. With established credibility, Vietnam still maintains its role as a key supplier, not only in the US but also in the global pepper market.

Read more: Spice export - New business opportunity for Vietnamese enterprises

2. Pepper consumption trends in the US

The US pepper market is witnessing clear changes in consumer behavior and preferences. Vietnamese enterprises need to clearly grasp these trends:

Prioritize safe, organic and sustainable products

American consumers are increasingly focusing on health and the environment, so the trend of choosing organic pepper is growing strongly. They prioritize products free of chemical residues, clearly certified safe such as USDA Organic or Non-GMO.

The trend of "clean eating, green living" becomes a driving force for producers to change, focusing on sustainable cultivation and processing processes.

Strongly increasing demand for processed pepper, diverse flavors

Strongly increasing demand for processed pepper, diverse flavors

In addition to traditional black pepper, consumers tend to look for processed products such as ground pepper, crushed pepper or flavor extracts. The diversity in flavors, from pink pepper to Sichuan pepper, helps meet the need for new culinary experiences and more convenience in daily cooking.

Expansion of the premium pepper segment

The premium pepper segment is expanding rapidly in the US. Gourmet consumers and high-end restaurants seek special types of pepper such as white pepper, green pepper or unique blends. This reflects the trend of enhancing culinary experiences and expressing customers' sophisticated lifestyles.

Consumers emphasize origin transparency and traceability

The trust of American consumers is associated with transparency. They want to know the origin of pepper, cultivation methods, processing and packaging processes. Labels such as "No preservatives", "Freshly packed" or electronic traceability systems are highly appreciated.

3. Current situation of pepper export from Vietnam to the US

Vietnamese pepper has been and is maintaining a strong position in the US, but the export picture still has both achievements and notable difficulties.

Export turnover and volume of Vietnamese pepper to the US

The US is currently the largest pepper import market of Vietnam. According to data from the Vietnam Pepper and Spice Association (VPSA), in 2024, Vietnam exported 15,265 tons of pepper to the US, reaching a turnover of 100.6 million USD.

In the whole year of 2024, the total pepper export volume of Vietnam reached about 250,600 tons, equivalent to 1.32 billion USD – reaching the highest export revenue record in many recent years. In January 2025 alone, pepper exports maintained strong growth, increasing by more than 30% compared to the same period in 2024.

These figures show that Vietnamese pepper plays an important role in the US pepper market. This is a large market, with stable demand, especially for dried spices and processed products.

Major challenges when bringing Vietnamese pepper to the US market

Major challenges when bringing Vietnamese pepper to the US market

In addition to positive results, pepper exports to the US still face many barriers:

First of all, the food safety regulations of the US Food and Drug Administration (FDA) are very strict. Enterprises must ensure not to exceed pesticide residue levels, not to contain impurities or harmful microorganisms, as well as comply with transparent traceability.

In addition, American consumers tend to prioritize products with organic and sustainable certifications, such as USDA Organic or Non-GMO Project Verified. This forces producers to invest in cultivation processes, quality control and modern processing technology.

Another challenge is fierce competition from major exporting countries such as Brazil, Indonesia or India. These countries are accelerating investment in clean and sustainable production, making the US pepper market increasingly difficult to maintain advantages.

4. Solutions to enhance the competitive advantage of Vietnamese pepper in the US market

To maintain its position as well as create a sustainable competitive advantage in the US pepper market, Vietnamese enterprises need to focus on the following strategic solutions:

4.1. Comply with international regulations and certifications on food safety

The US is one of the markets with the strictest food safety standards. Enterprises that want to successfully export must obtain certifications such as FDA, USDA Organic, Non-GMO, HACCP, GMP.

These certifications not only help overcome legal barriers but also build credibility in the eyes of American partners and consumers. Serious investment in international standard production and processing processes is a mandatory step if Vietnamese pepper wants to enhance its position.

4.2. Attractive packaging design, meeting FDA standards

Packaging not only protects the product but is also an important marketing tool, helping to create the first impression with customers. Enterprises need to pay attention to investing in professional, eye-catching packaging design, accurately reflecting the quality inside.

In particular, packaging must provide all necessary information according to FDA regulations, such as ingredients, expiration date, nutritional information and origin. The use of seals and anti-counterfeit labels also helps strengthen brand credibility in the eyes of customers.

Easy-to-open and resealable packaging design will bring outstanding convenience to users. Along with that, the use of environmentally friendly packaging materials is also a big plus, in line with the green consumption trend in the US.

Read more: All about FDA regulations for food packaging

4.3. Ensure consistent quality and transparent traceability

American consumers place high trust in quality stability. Enterprises need to maintain consistency in moisture, flavor, grain size... in each export shipment.

At the same time, the application of electronic traceability systems is an indispensable factor. Buyers can easily check the journey of the product from farm to table, thereby strengthening trust with the Vietnamese brand.

4.4. Diversify processed pepper products to meet the needs of the US market

In addition to black pepper, developing processed products such as pickled pepper, spike pepper, pepper essential oil, ground pepper, packaged pepper or organic pepper in line with modern consumption trends will expand the target customer group. Diverse products not only increase export value but also strengthen the Vietnamese brand in the international market.

The US is a market with high demand for convenient, organic and nutritious products. Investing in these product lines helps increase competitiveness and improve Vietnamese pepper export turnover more effectively.

4.5. Focus on the premium segment to enhance added value

4.5. Focus on the premium segment to enhance added value

To avoid dependence on bulk exports with low profit margins, Vietnamese enterprises should orient toward the premium segment – where customers are willing to pay more for superior quality products.

This could be organic pepper, regional specialty pepper or products with clear geographical indications. For example, the product “Tay Nguyen pepper” has the potential to become a premium product with its own identity, if invested in brand building and proper positioning.

4.6. Promote cross-border e-commerce

E-commerce is becoming an important distribution channel in the US. Pepper export enterprises can take advantage of major e-commerce platforms such as Amazon or Walmart to directly reach consumers, reducing dependence on traditional distribution channels.

To effectively exploit this channel, enterprises need to optimize products for the online environment: sharp images, clear description content, positive customer reviews and professional after-sales service. This is an important channel for Vietnamese pepper to affirm its position in the global shopping trend.

Read more: Guide to selling on Amazon

Read more: What is Walmart? Learn about Walmart & opportunities for Vietnamese products

5. Conclusion

The US pepper market continues to affirm its important role for Vietnamese pepper exports. This is a large market, demanding but also opening up many opportunities for businesses that know how to adapt.

To maintain their position, Vietnamese enterprises need to maintain stable quality, transparent origin, while diversifying products, focusing on the premium segment and exploiting e-commerce to enhance competitiveness.

Follow AGlobal to read more useful information.

Register NOW HERE or contact hotline 0888.608.007 to receive completely free support from AGlobal’s leading experts!

AGlobal – Amazon’s account management and advertising partner in Vietnam, helping more than 200+ export units streamline and effectively export goods.