Commodity Markets in 2025: Understanding them correctly for effective investment.

When global prices and demand fluctuate constantly, the commodity market emerges as an attractive destination for investors seeking stability. In today’s article, AGlobal will help you understand the commodity market, from its definition to its operating mechanism and investment potential in 2025.

1. Overview of the Commodity Market

The commodity market is an important foundation of the global economy, where the buying and selling of raw materials and basic products take place. Therefore, understanding this market helps businesses and investors become more proactive in business planning, risk management, and seizing profit opportunities.

1.1. What is the Commodity Market?

The commodity market is where the buying, selling, and exchange of raw or primary products such as agricultural products, metals, energy, or industrial materials take place. Transactions can occur directly between buyers and sellers or through electronic exchanges.

Unlike stocks or bonds, commodities in this market have real practical value in daily life and production. The commodity market is usually divided into two main groups: hard commodities (such as oil, gold, ore, rubber) and soft commodities (such as coffee, corn, sugar, meat, agricultural products).

Nowadays, in addition to physical trading, participants can also trade through derivative contracts – agreements to buy or sell commodities at a fixed price in the future. This form helps businesses and investors reduce risks when prices fluctuate while increasing profit opportunities and protecting asset value during inflation.

Read more: What is a derivative contract?

1.2. The Role of the Commodity Market

Through trading activities, the commodity market helps balance supply and demand, form reasonable prices, and create development motivation for businesses, investors, and the entire production chain. Some outstanding roles include:

- Creating a transparent trading environment: Helping buyers and sellers easily meet, exchange information, and make transactions quickly and efficiently.

- Reflecting market supply and demand: Commodity prices change according to demand and production, helping businesses adjust production plans and business strategies.

- Stabilizing the economy and ensuring supply: Helping goods circulate continuously, avoiding shortages or surpluses.

- Opening up investment opportunities: Investors can join the commodity market to diversify portfolios and hedge risks against price fluctuations.

- Promoting international trade: Commodity trading between countries helps expand markets, increase import-export growth, and contribute to global economic development.

2. Characteristics of Vietnam’s Commodity Market

Vietnam’s commodity market is developing rapidly alongside stable economic growth. With nearly 100 million people and a young workforce, Vietnam is considered a dynamic and potential consumer market. The process of industrialization and export orientation has increased the demand for raw materials, machinery, and production equipment in recent years.

Thanks to its favorable geographical location with three sides facing the sea, Vietnam’s international trade activities are vibrant and convenient. According to the Vietnam Commodity Exchange (MXV), Vietnam’s commodity market continues to grow strongly, with Q3 trading volume increasing by 43.9% compared to the same period last year, showing the great attractiveness of this investment channel.

At the same time, import turnover has steadily increased over the years, focusing on two main groups:

- Goods serving production and export such as machinery, components, raw materials

- Domestic consumer goods such as food, pharmaceuticals, cosmetics, phones, automobile

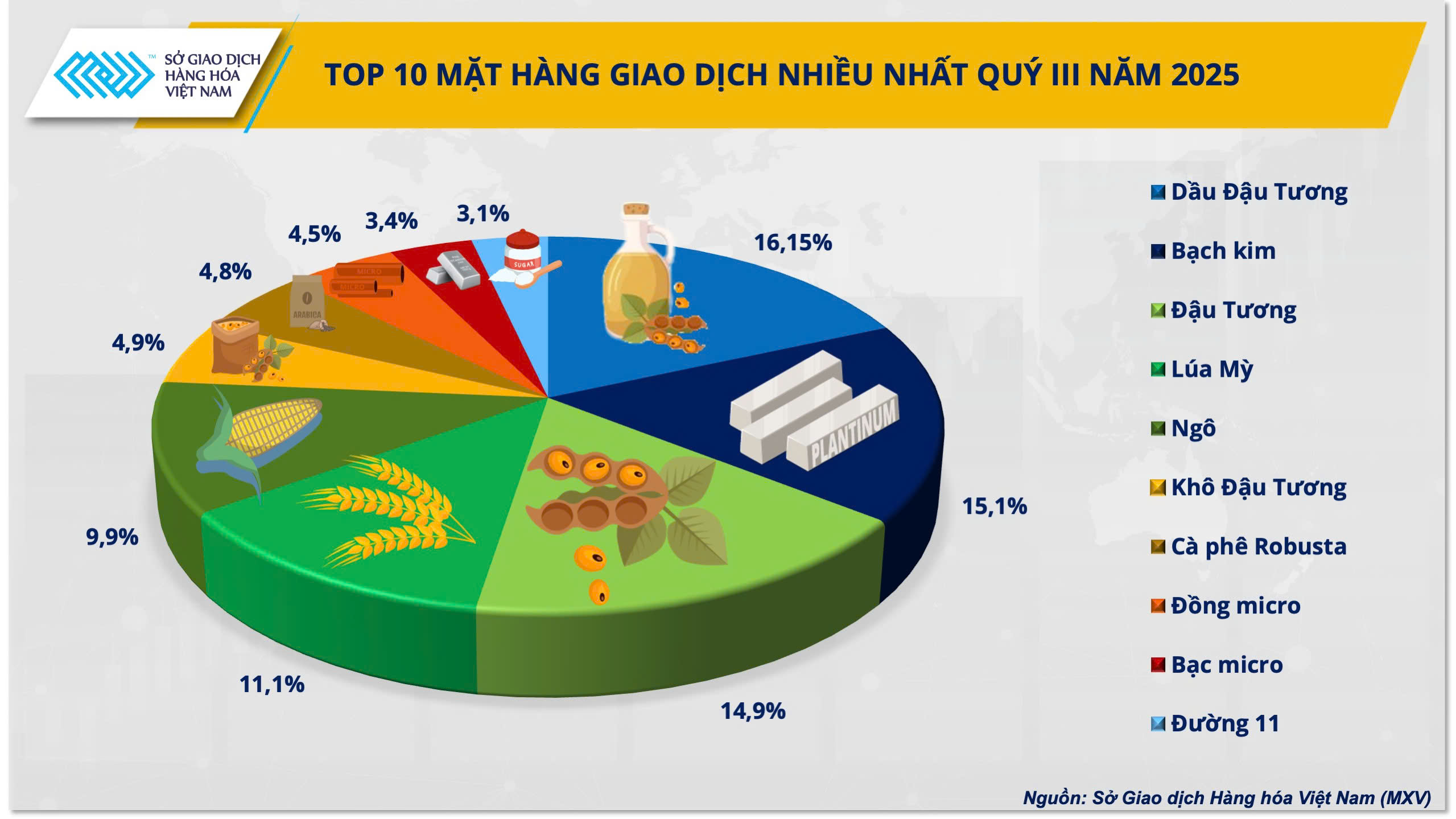

Top 10 most traded commodities in Q3/2025

In general, Vietnam’s commodity market is characterized by diversity, openness, and integration with the global economy, serving both domestic consumption and supporting production and export growth.

Read more: Commodity brokerage market share: Stable at the top, dynamic in the chase behind

3. Four Main Commodity Groups

Currently, the commodity market is divided into four main groups, each with its own characteristics and role in global trade and production activities.

- Agricultural products group: This group holds the largest share, including essential goods such as rice, corn, wheat, soybeans, sugarcane, etc. It directly affects food security and people’s livelihoods.

- Industrial materials group: Includes products serving processing and production such as rubber, coffee, cotton, sugar… This is an important supply source for many industries and Vietnam’s exports.

- Metals group: Includes gold, silver, copper, iron, and other metal ores. This group plays an essential role in construction, heavy industry, and is also a popular investment channel.

- Energy group: Includes crude oil, natural gas, and gasoline. This group greatly affects the entire economy as it directly impacts production costs, transportation, and consumer prices.

4. How the Commodity Market Works

The commodity market operates based on the principle of supply and demand. When demand increases, prices tend to rise. Conversely, when supply exceeds demand, prices fall. This mechanism helps the market self-balance and reflect the true value of goods.

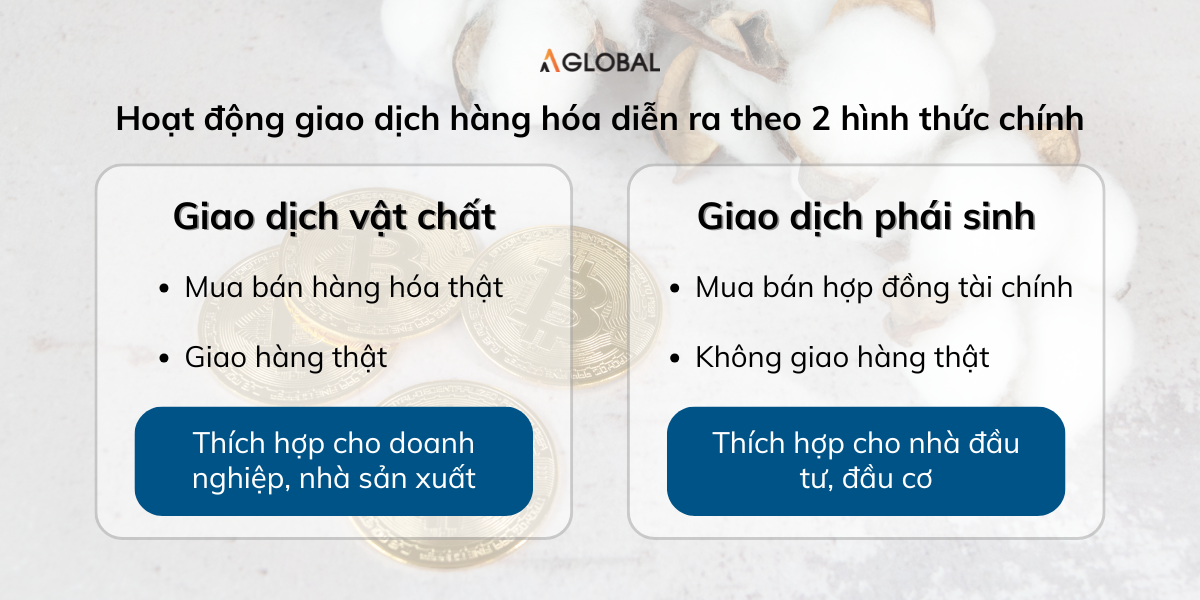

Commodity trading activities take place in two main forms

Common tools in derivative trading include forwards, futures, swaps, and options contracts. These tools help buyers and sellers hedge against price fluctuations. For example, farmers can lock in the selling price of crops before harvest.

Nowadays, thanks to technology, the commodity market also includes modern investment forms such as ETFs, allowing investors to trade commodities electronically without holding physical assets. This makes investing more flexible and accessible.

5. How to Participate and Trade in the Commodity Market 2025

To invest effectively in the commodities market in 2025, investors need to understand the different ways to participate and choose a reputable and suitable trading platform.

5.1. Three Common Ways to Participate in the Commodity Market

To participate in the commodity market, investors can choose one of the three common forms below. Each has different characteristics and risk levels:

- Buying shares in companies dependent on commodity prices: Investors can buy shares of companies engaged in extraction, production, or export of raw materials. When commodity prices rise, these companies’ profits usually increase, giving investors opportunities for growth.

- Investing in mutual funds or ETFs specializing in commodities or commodity companies: This is an indirect way through purchasing fund certificates. These funds use capital to invest in businesses or global commodity indices. Investors can benefit from price movements without directly trading.

- Trading commodity futures contracts or derivatives: This allows investors to participate directly in commodity price movements through the Vietnam Commodity Exchange (MXV). Participants must open a margin account at an MXV brokerage member to execute buy or sell contracts at predetermined prices and times.

See more: Detailed procedures for issuing certificates of origin 2025

5.2. Reputable Commodity Exchanges Today

The global commodity market is currently operated through many exchanges. Each exchange has its own strengths in specific groups of goods. Below are some prominent exchanges with major influence globally and in Vietnam.

5.2.1. Chicago Mercantile Exchange (CME)

CME is the largest commodity exchange in the world, headquartered in the United States. Here, investors can trade various commodities such as agricultural products, energy, metals, currencies, and stock indices.

Thanks to modern technology, CME allows global online trading, ensuring transparency, high speed, and effective risk management. It is also where benchmark prices for many international commodities are formed.

5.2.2. New York Mercantile Exchange (NYMEX)

NYMEX, now part of CME Group, provides a transparent, safe trading environment and is used by businesses and investors to protect profits against market price fluctuations.

NYMEX specializes in energy and precious metal products such as crude oil, natural gas, gold, and silver. It helps determine the benchmark price for WTI oil – one of the world’s most important indices.

5.2.3. London Metal Exchange (LME)

LME is the largest and oldest metal exchange in the world, headquartered in the UK. Main traded items include copper, aluminum, zinc, nickel, tin, and lead. Global metal prices are often based on LME benchmarks, so it plays an extremely important role in pricing and stabilizing the global industrial metal market.

5.2.4. Mercantile Exchange of Vietnam (MXV)

MXV is the only commodity exchange licensed by the Ministry of Industry and Trade in Vietnam. MXV is directly connected to major international exchanges such as CME, ICE, LME, and TOCOM, allowing domestic investors to legally and transparently trade global commodities.

At MXV, popular products include agricultural goods, metals, energy, and industrial materials, traded through a modern software system. As a result, MXV is gradually becoming a new, safe, and potential investment channel for Vietnamese investors.

6. Conclusion

The commodity market is a pillar of the global economy and offers many opportunities for Vietnamese investors. Understanding supply-demand mechanisms, derivative tools, and choosing suitable investment channels will help you stay proactive amid price fluctuations and optimize profits. As integration deepens, keeping up with trends and market information from MXV and reputable international exchanges will help you invest more confidently and effectively.

AGlobal – the best cross-border e-commerce solution for businesses.

Register for a free 1-on-1 consultation tailored to your business sector Here!