Coffee Market in Q4/2025: Golden Opportunities for Vietnamese Enterprises

The global coffee market in Q4/2025 promises significant changes as global demand rises sharply and consumer trends evolve. This is a golden time for Vietnamese businesses to assert their position, expand exports, and increase value in the international coffee market.

1. Global Coffee Market Overview

The global coffee market in Q4/2025 is expected to be vibrant yet full of challenges. While production in some countries is recovering, weather conditions, trade issues, and geopolitical tensions are keeping coffee prices high.

According to the International Coffee Organization (ICO), the 2023/24 crop year recorded consumption of about 177 million bags, reflecting strong demand and robust growth potential.

1.1. Leading Coffee-Producing Countries

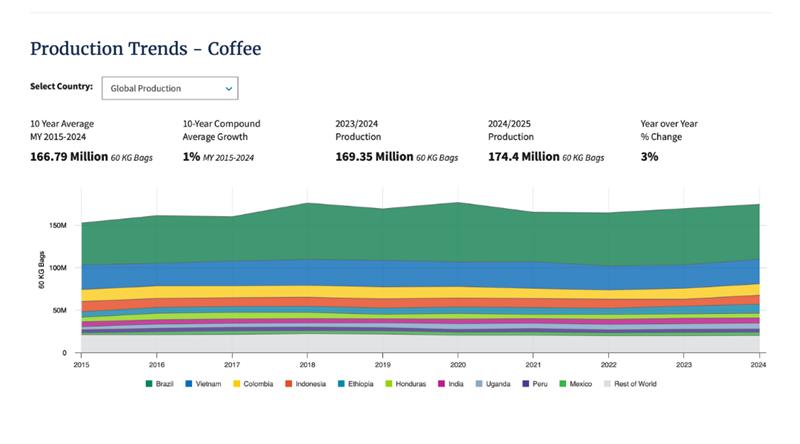

Brazil, Vietnam, and Colombia remain the pillars of global coffee production. Brazil leads with more than 64.7 million bags (37% of global output).

Vietnam ranks second with nearly 29 million bags of Robusta, while Colombia holds third place with over 13.2 million bags of high-quality Arabica. Indonesia and Ethiopia also feature among the top five producers.

Source: USDA

1.2. Largest Coffee-Consuming Markets

On the consumption side, the European Union (EU) is the top importer with more than 48 million bags in 2024. The United States is the largest single-country market with about 25 million bags annually, shaping the Arabica–Robusta blending trend.

These two markets heavily influence global pricing and strategic directions of international coffee corporations.

1.3. Key Global Coffee Trends

- High coffee prices: Limited supply, low inventory, and unstable trade policies are driving prices upward. The U.S. imposing a 50% tariff on Brazilian coffee from August 2025 may redirect trade flows toward Asia and Europe, creating opportunities for Vietnamese exporters.

- Specialty coffee expansion: Consumers increasingly value quality, origin, and sustainability.

- Ready-to-drink (RTD) coffee boom: Low-sugar, health-oriented RTD products are on the rise, catering to fast-paced lifestyles.

In this context, Vietnamese Robusta has become a stable supply source, helping balance the global market and reinforcing Vietnam’s position as a leading exporter.

2. Vietnam’s Position in the Global Coffee Market

Vietnam has affirmed its strategic role as the world’s leading Robusta supplier, directly influencing global supply. According to USDA, in the 2024/25 crop year, Vietnam exported about 29 million bags, accounting for nearly 17% of global output, second only to Brazil.

2.1. Positioning Vietnamese Coffee on the World Map

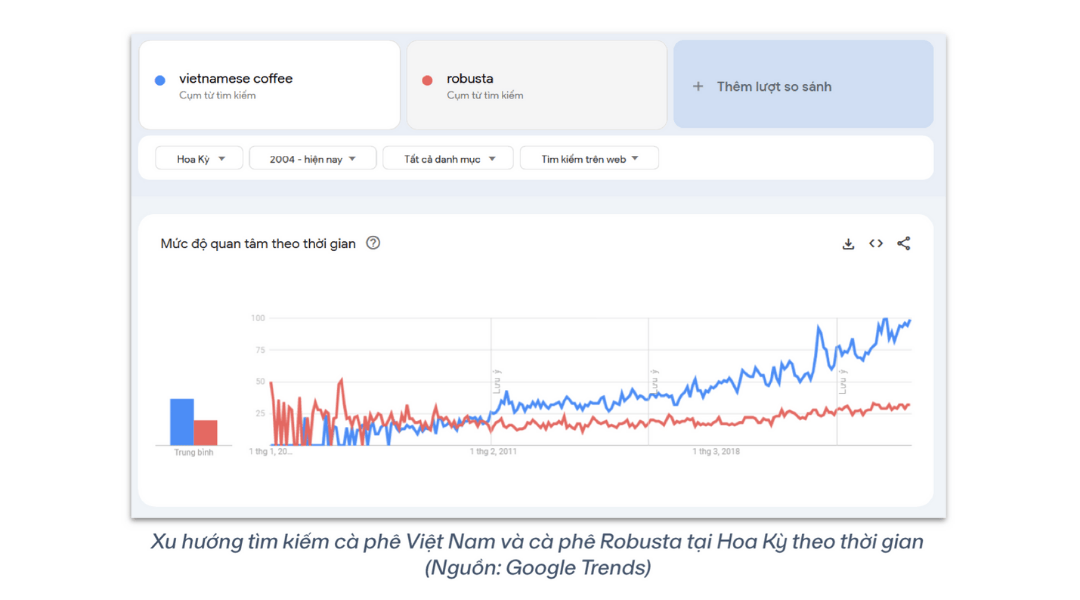

Although Vietnam is the world’s second-largest exporter, its image is still closely tied to Robusta, which is mainly used in industrial products and has yet to reach specialty status in the global coffee industry.

To strengthen its global presence, Vietnam is focusing on brand-building and product quality enhancement. Key directions include:

- Developing Arabica production, though limited in scale, to penetrate the specialty coffee market.

- Upgrading Robusta quality to move it up the value chain.

Arabica from regions like Cầu Đất (Lâm Đồng) is improving in quality, aiming at the specialty segment – a major international trend. This will enhance Vietnam’s coffee value and integrate it deeper into premium supply chains.

2.2. Most Popular Vietnamese Coffee Types

- Robusta: Accounts for over 90% of Vietnam’s coffee exports, highly consumed in the EU, U.S., and Japan. With strong flavor, high caffeine, and competitive prices, Vietnamese Robusta remains popular in instant coffee, blends, and RTD products.

- Arabica: Cultivated in areas like Cầu Đất (Lâm Đồng), Vietnamese Arabica offers floral aroma and bright acidity, increasingly recognized in global competitions. Though small in volume, it elevates Vietnam’s image in specialty coffee.

- Processed coffee products: Includes instant coffee, 3-in-1, and RTD. Many Vietnamese firms are investing in this high-value segment to reduce reliance on raw exports.

3. Golden Opportunities for Vietnamese Coffee Enterprises

3.1. Export Expansion Potential

According to USDA, Vietnam exported 29 million bags (60kg each) in 2024/25, representing 17% of global production. This is forecasted to rise to 31 million bags in 2025/26.

With rising Robusta demand in Europe and Asia, alongside U.S. tariffs on Brazilian coffee, Vietnam has a major competitive edge. Importers require stable supply, and Vietnam is the best alternative.

Beyond the EU and U.S., emerging markets in the Middle East and East Asia are also increasing imports – opening new opportunities for Vietnamese businesses to expand globally.

3.2. Building Vietnamese Coffee Brands: Specialty and Sustainable Coffee

To add value, Vietnamese enterprises need to move beyond raw exports toward specialty coffee. Arabica from Sơn La or Lâm Đồng is a promising path.

Global consumers are also prioritizing sustainability. Investments in certifications like Fair Trade or Rainforest Alliance will boost credibility and competitiveness.

3.3. Investing in Cross-Border E-Commerce

Cross-border e-commerce (CBEC) is becoming the fastest route for Vietnamese coffee to reach global consumers. Selling on platforms like Amazon, Alibaba, and Shopee Global enables businesses to:

- Cut intermediaries, increasing profit margins.

- Build a clearer “Made in Vietnam” brand.

- Collect consumer data to improve products.

In fact, brands like Trung Nguyên Legend and TNI King Coffee have achieved million-dollar revenues on Amazon, proving CBEC is not just a trend but a strategic path for global integration.

Read more: New! Key notes when exporting coffee on Amazon

3.4. Increasing Value with Deep Processing

Currently, about 90% of Vietnamese coffee is exported raw, while the markets for instant, capsule, and RTD coffee are growing rapidly and offer far higher value.

Pioneers like Nestlé, Trung Nguyên, and Vinacafé demonstrate that deep processing not only raises product value but also strengthens brand position in both domestic and international markets.

Read more: Vietnam’s Instant Coffee Market: Opportunities and Challenges

4. Challenges Facing Vietnamese Coffee Enterprises

4.1. Price Volatility in the Global Coffee Market

Global coffee prices are under pressure from climate change, unstable supply, and trade fluctuations.

- Severe drought in Brazil in 2024 pushed Arabica prices up 70%, hitting a record $4.30/pound in early 2025 on the New York exchange.

- Robusta prices also rose 72% in 2024, reaching nearly $5,847/ton internationally.

Such volatility makes long-term planning difficult, raising financial risks for exporters.

4.2. Trade Barriers and Logistics Challenges

Besides prices and quality, exporters face high tariffs, strict quality checks, and rising logistics costs. Shipping to Europe or the U.S. is heavily impacted by volatile freight rates.

Additionally, new regulations, such as requiring lower CO₂ emissions in supply chains, add further pressure.

4.3. Stricter Quality and Sustainability Standards

Consumers are increasingly demanding sustainable production. Certifications like Fairtrade and Rainforest Alliance are becoming essential for entering international supply chains.

This requires Vietnamese enterprises to invest in clean technology, transparency, and sustainable practices – or risk losing competitiveness.

Read more: Coffee Certifications that Sellers Should Pay Attention To

5. Conclusion

The global coffee market in Q4/2025 presents both opportunities and challenges. While demand continues to grow, Vietnam is strengthening its global position with strong production and quality advantages.

However, fierce competition and rising international standards demand continuous innovation. If Vietnamese enterprises can seize this moment, Vietnamese coffee will not only increase in value but also solidify its role on the global coffee map.

Follow AGlobal to explore more valuable insights.

Register HERE or contact our hotline 0888.608.007 to receive free support from AGlobal’s top experts!

AGlobal – Your trusted partner for Amazon account management and advertising in Vietnam, empowering 200+ exporters to simplify, streamline, and succeed.